myCBSEguide App

Download the app to get CBSE Sample Papers 2023-24, NCERT Solutions (Revised), Most Important Questions, Previous Year Question Bank, Mock Tests, and Detailed Notes.

Install NowNCERT Solutions for class 12 Business studies Financial Management Class 12 Business studies Class book solutions are available in PDF format for free download. These ncert book chapter wise questions and answers are very helpful for CBSE board exam. CBSE recommends NCERT books and most of the questions in CBSE exam are asked from NCERT text books. Class 12 Business studies chapter wise NCERT solution for Business studies part 1 and Business studies part 2 for all the chapters can be downloaded from our website and myCBSEguide mobile app for free.

Download NCERT solutions for Financial Management as PDF.

NCERT Class 12 Business studies Chapter wise Solutions

Business Studies Part – I

- 1 – Nature and Significance of Management

- 2 – Principles of Management

- 3 – Management and Business Environment

- 4 – Planning

- 5 – Organising

- 6 – Staffing

- 7 – Directing

- 8 – Controlling

Business Studies Part – I I

- 9 – Business Finance

- 10 – Financial markets

- 11 – Marketing

- 12 – Consumer Protection

- 13 – Entreprenuership Development

Chapter Financial Management

- Financial Management, Financial Decisions and Financial Planning

- Capital Structure: Concept

- Fixed and Working Capital: Concept and Determinants

NCERT Solutions for class 12 Business studies Financial Management

Multiple Choice:

1. The cheapest source of finance is

- (a) debenture

- (b) equity share capital

- (c) preference share

- (d) retained earning

Ans: (d) The cheapest source of finance is retained earnings. Retained income refers to that portion of net income or profits of an organisation that it retains after paying off dividends. An organisation can reinvest its retained earnings or profits for the purpose expansion, modernisation, etc. It neither involves any fund raising cost nor any risk. Also, unlike other sources of finance it does not involve any obligation in terms of repayment.

NCERT Solutions for class 12 Business studies Financial Management

2. A decision to acquire a new and modern plant to upgrade an old one is a

- (a) financing decision

- (b) working capital decision

- (c) investment decision

- (d) None of the above

Ans: (c) The decision to acquire a new and modern plant to upgrade an old one is an Investment decision. Investment decision refers to the decision regarding where the funds are to be invested so as to earn the highest possible return. The decision to acquire a new plant is a long term investment decision and affects long run working and earning capacity of the business.

On the other hand, working capital decisions refer to those investment decisions that influence the day to day working of the business. While, financing decision refers to the decisions regarding the sources from where the funds can be raised.

NCERT Solutions for class 12 Business studies Financial Management

3. Other things remaining the same, an increase in the tax rate on corporate profit will

- (a) make the debt relatively cheaper

- (b) make the debt relatively the dearer

- (c) have no impact on the cost of debt

- (d) we can’t say

Ans: (a) When there is an increase in the tax on corporate profit, the debt becomes relatively cheaper. This is because interest that is to be paid to the debtors is deducted from the total income before calculating the value of tax. Thus, as the value of tax increases, the debt becomes relatively cheaper.

NCERT Solutions for class 12 Business studies Financial Management

4. Companies with a higher growth potential are likely to

- (a) pay lower dividends

- (b) pay higher dividends

- (c) dividends are not affected

- (d) none of the above

Ans (a) Companies which have higher growth potential are likely to pay lower dividends. This is because the companies having higher growth potential have greater investment plans and require larger funds for investment. Thus, they retain a greater portion of their earnings to finance the required investment and thereby, pay lower dividends.

NCERT Solutions for class 12 Business studies Financial Management

5. Financial leverage is called favourable if

- (a) Return on investment is lower than the cost of debt

- (b) ROI is higher than the cost of debt

- (c) Debt is easily available

- (d) If the degree of existing financial leverage is low

Ans: (b) Financial Leverage refers to the proportion of debt in the overall capital. It is said to be a favourable situation when the return on investment becomes higher than the cost of debt. In other words, as the Return on investment becomes greater, the earning per share also increases and the financial leverage is said to be favourable.

NCERT Solutions for class 12 Business studies Financial Management

6. Higher debt-equity ratio results in

- (a) lower financial risk

- (b) higher degree of operating risk

- (c) higher degree of financial risk

- (d) higher EPS

Ans: (c) Higher debt- equity ratio refers to a situation where the proportion of debt in total capital is higher. This implies higher degree of financial risk. This is because in case of debt, it is obligatory for a business to make interest payments and the return of principal to the debtors. Thus, higher debt increases the financial risk for the business.

NCERT Solutions for class 12 Business studies Financial Management

7. Higher working capital usually results in

- (a) higher current ratio, higher risk and higher profits

- (b) lower current ratio, higher risk and profits

- (c) higher equity, lower risk and lower profits

- (d) lower equity, lower risk and higher profits

Ans: (a) Working capital of a firm refers to the amount of current assets which are in excess over current liabilities. If a company has a higher working capital then there will be a higher current ratio (i.e. current assets over current liabilities), higher risk and higher profits.

NCERT Solutions for class 12 Business studies Financial Management

8. Current assets are those assets which get converted into cash

- (a) within six months

- (b) within one year

- (c) between one year and three years

- (d) between three and five years

Ans: (b) Current assets are those assets which can be converted into cash or can be used to pay off liabilities within a time span of 12 months, i.e. one year. Some of the examples of current assets are cash, cash equivalents, inventories, debtors, bills receivables, etc.

NCERT Solutions for class 12 Business studies Financial Management

9. Financial planning arrives at

- (a) minimising the external borrowing by resorting to equity issues

- (b) entering that the firm always have significantly more fund than required so that there is no paucity of funds

- (c) ensuring that the firm faces neither a shortage nor a glut of unusable funds

- (d) doing only what is possible with the funds that the firms has at its disposal

Ans: (c) Financial Planning aims at ensuring that the firm faces neither a shortage nor a glut (excess) of unusable funds. If there is a shortage of funds then the firm will not be able to carry out its planned activities and commitments. On the other hand, if there are excess funds available then it adds to the cost of business and also encourages wastage of funds. Thus, financial planning focuses on ensuring the availability of just enough funds at the right time.

NCERT Solutions for class 12 Business studies Financial Management

10. Higher dividend per share is associated with

- (a) high earnings, high cash flows, unstable earnings and higher growth opportunities

- (b) high earnings, high cash flows, stable earnings and high growth opportunities

- (c) high earnings, high cash flows, stable earnings and lower growth opportunities

- (d) high earnings, low cash flows, stable earnings and lower growth opportunities

Ans: (d) If a company gives higher dividend per share then it gets associated with high amount of earnings as only if they will earn higher, they will be able to give higher dividends; higher cash flow as the payment of dividend involves cash outflow; stable earnings as stable earnings means that the company is confident of its future earning potentials; and lower growth opportunities because it requires less requirement of retained earnings and their retained earnings while lowering the amount of dividends paid.

NCERT Solutions for class 12 Business studies Financial Management

11. A fixed asset should be financed through

- (a) a long term liability

- (b) a short term liability

- (c) a mix of long and short term liabilities

Ans : (a) Fixed assets are those assets which are invested in a company for a longer time period, generally more than one year. As these assets have long term implication on the business in terms of growth and profitability, they should be financed through long term liabilities such as long term loans, preference shares, retained earnings, etc.

NCERT Solutions for class 12 Business studies Financial Management

12. Current assets of a business firm should be financed through

- (a) current liability only

- (b) long-term liability only

- (c) both types (i.e. Long and short liabilities)

Ans: (c) Current assets are those assets which get converted in cash or cash equivalents within a short span of time and provide liquidity to a business. For financing the current assets of a business, both types of liabilities (short and long) can be used.

NCERT Solutions for class 12 Business studies Financial Management

Short Answer Type:

1. What is meant by capital structure?

Ans: Capital structure refers to the combination of borrowed funds and owners’ fund that a firm uses for financing its fund requirements. Herein, borrowed funds comprise of loans, public deposits, debentures, etc. and owners’ fund comprise of preference share capital, equity share capital, retained earning etc. Generally, capital structure is simply referred as the combination of debt and equity that a firm uses for financing its funds. It is calculated as the ratio of debt and equity or the proportion of debt in the total capital used by the firm. Algebraically,

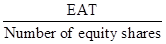

Capital Structure is

Or,

The proportion of the debt and equity used by the firm affects its financial risk and profitability. While on one hand, debt is a cheaper source of finance than equity and lowers the overall cost of capital but on the other hand, higher use of debt, increases the financial risk for the firm. Thus, the decision regarding the capital structure should be taken with utmost care. Capital structure is said to be optimal when the proportion of debt and equity used is such that the earnings per share increases.

NCERT Solutions for class 12 Business studies Financial Management

2. Discuss the two objective of Financial Planning.

Ans: Financial Planning involves designing the blueprint of the financial operations of a firm. It ensures that just the right amount of funds are available for the organisational operations at the right time. Thereby, it ensures smooth functioning. Taking into consideration the growth and performance, through financial planning, firms tend to forecast what amount of fund would be required at what time. The following are the two highlighted objectives of financial planning.

(i) Ensure Availability of Funds: Ensuring that the right amount of funds are available at the right time is one of the main objectives of financial planning. It involves estimating the right amount of funds that are required for various business operations in the long term as well for day to day operations. In addition, it also involves estimating the time at which the funds would be required. Thus, financial planning ensures that right amount of funds are available at the right time. Financial planning also points out the probable sources of funds.

(ii) Proper Utilisation of Funds: Financial Planning aims at full utilisation of funds. It ensures that both inadequate funds as well as excess funds are avoided. Inadequate funds hinders the smooth operations and the firm is unable to carry its commitments. On the other hand, excess funds add to the cost of business and encourage unnecessary wasteful expenditure. Thus, financial planning ensures that the funds are properly and optimally utilised.

NCERT Solutions for class 12 Business studies Financial Management

3. What is financial risk? Why does it arise?

Ans: Financial risk refers to a situation when a company is not able to meet its fixed financial charges such as interest payment, preference dividend and repayment obligations. In other words, it refers to the probability that the company would not be able to meet its fixed financial obligations. It arises when the proportion of debt in the capital structure increases. This is because it is obligatory for the company to pay the interest charges on debt along with the principle amount. Thus, higher the debt, higher will be its payment obligations and thereby higher would be the chances of default on payment. Hence, higher use of debt leads to higher financial risk for the company.

NCERT Solutions for class 12 Business studies Financial Management

4. Define a ‘current asset’. Give four examples of such assets.

Ans: Current asset of a firm refers to those assets which can be converted into cash or cash equivalents in a short period of time, i.e. less than one year. Such assets are used to facilitate the day to day business operations. As they can be easily converted into cash or cash equivalents, these assets provide liquidity to the company. Firms acquire such assets to meet its various payment obligations. However, such assets provide very little return and are thereby, less profitable. Current assets can be financed through short-term as well as long term sources.

Some of the examples of current assets are short term investment, debtors, stocks and cash equivalents.

NCERT Solutions for class 12 Business studies Financial Management

5. Financial management is based on three broad financial decisions. What are these?

Ans: Financial management refers to the efficient acquisition, allocation and usage of funds of the company. It deals in three main dimensions of financial decisions namely, Investment decisions, Financial decisions and Dividend decisions.

Investment Decisions: Investment decisions refer to the decisions regarding where to invest so as to earn the highest possible returns on investment. Investment decisions can be taken for both long term as well as short term.

Long term investment decisions also known as Capital Budgeting decisions affect a business’ long term earning capacity and profitability. For example, investment in a new machine, purchase of a new building, etc. are long term investment decisions.

Short term investment decisions also known as working capital decisions affect a business’ day to day working operations. For example, decisions regarding cash or bill receivables are short term investment decisions.

Financial Decisions: Such decisions involve identifying various sources of funds and deciding the best combination for raising the funds. The main sources for raising funds are shareholders’ funds (referred as equity) and borrowed funds (referred as debt). Based on the cost involved, risk and profitability a company must judiciously decide the combination of debt and equity to be used. For example, while debt is considered to be the cheapest source of finance, higher debt increases the financial risk. Financial decisions taken by a company affects its overall cost of capital and the financial risk.

Dividend Decisions:

The decision involves the decision regarding the distribution of profit or surplus of the company. A company can distribute its profit to the equity shareholders in the form of dividends or retain it with itself. Under dividend decision, a company decides what proportion of the surplus to distribute as dividends and what proportion to keep as retained earnings. It is aimed at maximising the shareholders’ wealth while keeping in view the requirement of retained earnings that are needed for re-investment.

NCERT Solutions for class 12 Business studies Financial Management

6. What are the main objectives of financial management? Briefly explain

Ans: The paramount objective of the financial management is maximising the shareholders’ wealth. That is, the basic objective of financial management for a company is to opt for those financial decisions that prove gainful from the point of view of the shareholders. The shareholders are said to gain when the market value of their shares rise. The market value of shares increase when the benefits from a financial decision exceed the cost involved in taking them. In other words, a financial decision raises the market value of share if it results in some value addition. Thus, financial decisions should be taken such that some value addition takes place and ultimately the price of the equity share increases. When a financial decision is able to fulfil the primary objective of wealth maximisation, other objectives such as proper utilisation of funds, maintenance of liquidity etc. are automatically fulfilled.

NCERT Solutions for class 12 Business studies Financial Management

7. How does working capital affect both the liquidity as well as profitability of a business?

Ans: Working capital of a business refers to the excess of current assets (such as cash in hand, debtors, stock, etc.) over current liabilities. Working capital affects both the liquidity as well as profitability of a business. As the amount of working capital increases, the liquidity of the business increases. However, since current assets offer low return, with the increase in working capital the profitability of the business falls. For example, an increase in the inventory of the business increases its liquidity but since the stock is kept idle, the profitability falls. On the other hand, low working capital, hinders the day to day operations of the business. Thus, the working capital should be such that a balance is maintained between the profitability and liquidity.

NCERT Solutions for class 12 Business studies Financial Management

Long Answer Type:

1. What is working capital? How is it calculated? Discuss five important determinants of working capital requirement.

Ans: Every business needs to take the decision regarding the investment in current assets i.e. the working capital. Current assets refer to the assets that are converted into cash or cash equivalents in a short period of time (less than or equal to one year). There are two broad concepts of working capital namely, Gross working capital and Net working capital.

Gross working capital (or, simply working capital) refers to the investment done in the current assets. Net working capital, on the other hand, refers to the amount of current assets that is in excess of current liabilities. Herein, current liabilities are those obligatory payments which are due for payment such as bills payable, outstanding expenses, creditors, etc. Net Working Capital is calculated as the difference of current assets over current liabilities. i.e.

NWC = Current Assets – Current Liabilities

The following are five determinants of working capital requirement:

(i) Type of Business: Working capital requirement of a firm depends on its nature of business. An organisation that deals in services or trading will not require much of working capital. This is because such organisations involve small operating cycle and there is no processing done. Herein, the raw materials are the same as the outputs and the sales transaction takes place immediately. In contrast to this, a manufacturing firm involves large operating cycle and the raw materials need to be converted into finished goods before the final sale transaction takes place. Thereby, such firms require large working capital.

(ii) Scale of Operations:

Another factor determining the working capital requirement is the scale of operations in which the firm deals. If a firm operates on a big scale, the requirement of the working capital increases. This is because such firms would need to maintain high stock of inventory and debtors. In contrast to this, if the scale of operation is small, the requirement of the working capital will be less.

(iii) Fluctuations in Business Cycle: Different phases of business cycle alter the working capital requirements by a firm. During boom period, the market flourishes and thereby, there is higher sale, higher production, higher stock and debtors. Thus, during this period the need for working capital increases. As against this, in a period of depression there is low demand, lesser production and sale, etc. Thus, the working capital requirement reduces.

(iv) Production Cycle: The time period between the conversion of raw materials into finished goods is referred as production cycle. The span of production cycle is different for different firms depending on which the requirement of working capital is determined. If a firm has a longer span of production cycle, i.e. if there is a long time gap between the receipt of raw materials and their conversion into final finished goods, then there will be a high requirement of working capital due to inventories and related expenses. On the other hand, if the production cycle is short then requirement of working capital will be low.

(v) Growth Prospects: Higher growth and expansion is related to higher production, more sales, more inputs, etc. Thus, companies with higher growth prospects require higher amount of working capital and vice versa.

NCERT Solutions for class 12 Business studies Financial Management

2. ”Capital structure decision is essentially optimisation of risk-return relationship”. Comment.

Ans: Capital Structure refers to the combination of different financial sources used by a company for raising funds. The sources of raising funds can be classified on the basis of ownership into two categories as borrowed funds and owners’ fund. Borrowed funds are in the form of loans, debentures, borrowings from banks, public deposits, etc. On the other hand, owners’ funds are in the form of reserves, preference share capital, equity share capital, retained earnings, etc. Thus, capital structure refers to the combination of borrowed funds and owners’ fund. For simplicity, all borrowed funds are referred as debt and all owners’ funds are referred as equity. Thus, capital structure refers to the combination of debt and equity to be used by the company. The capital structure used by the company depends on the risks and returns of the various alternative sources.

Both debt and equity involve their respective risk and profitability considerations. While on one hand, debt is a cheaper source of finance but involves greater risk, on the other hand, although equity is comparatively expensive, they are relatively safe.

The cost of debt is less because it involves low risk for lenders as they earn an assured amount of return. Thereby, they require a low rate of return which lowers the costs to the firm. In addition to this, the interest on debt is deductible from the taxable income (i.e. interest that is to be paid to the debt security holders is deducted from the total income before paying the tax). Thus, higher return can be achieved through debt at a lower cost. In contrast, raising funds through equity is expensive as it involves certain floatation cost as well. Also, the dividends are paid to the shareholders out of after tax profits.

NCERT Solutions for class 12 Business studies Financial Management

Though debt is cheaper, higher debt raises the financial risk. This is due to the fact that debt involves obligatory payments to the lenders. Any default in payment of the interest can lead to the liquidation of the firm. As against this, there is no such compulsion in case of dividend payment to shareholders. Thus, high debt is related to high risk.

Another factor that affects the choice of capital structure is the return offered by various sources. The return offered by each source determines the value of earning per share. A high use of debt increases the earning per share of a company (this situation is called Trading on Equity). This is because as debt increases the difference between Return on Investment and the cost of debt increases and so does the EPS. Thus, there is a high return on debt. However, even though higher debt leads to higher returns but it also increases the risk to the company.

Therefore, the decision regarding the capital structure should be taken very carefully, taking into consideration the return and risk involved.

NCERT Solutions for class 12 Business studies Financial Management

3. ”A capital budgeting decision is capable of changing the financial fortunes of a business”. Do you agree? Why or why not?

Ans: Yes, capital budgeting decision is a very essential decision which needs to be taken carefully. It has the capability of changing the financial fortunes of a business. Capital budgeting decision refers to the decisions regarding the allocation of fixed capital to different projects. Such decisions involve investment decisions regarding attainment of new assets, expansion, modernisation and replacement. Such long term investments include purchasing plant and machinery, furniture, land, building, etc. and also expenditure as on launch of a new product, modernisation and advertising, etc. They have long term implications on the business and are irrevocable except at a huge cost. They affect a business’ long term growth, profitability and risk.

The following are the factors that highlight the importance of capital budgeting decisions:

(i) Long Term Implications: Investment on capital assets (long term assets) yield return in the future. Thereby, they affect the future prospects of a company. A company’s long term growth prospects depend on the capital budgeting decisions taken by it.

(ii) Huge Amount of Funds: Investing in fixed capital involves a large amount of funds. This makes the capital budgeting decisions all the more important as huge amount of funds remain blocked for a longer period of time. These decisions once made are difficult to change. Thus, capital budgeting decisions need to be taken carefully after a detailed study of the total requirement of funds and the sources from which they are to be raised.

(iii) High Risk:

Fixed assets involve huge amount of money and thereby, involve huge risk as well. Such decisions are risky as they have an impact on the long term existence of the company. For example, decision about the purchase of new machinery involves a risk in terms of whether the return from the machinery would be greater than the cost incurred on it.

(iv) Irreversible Decisions: These decisions once made are irrevocable. Reversing a capital budgeting decision involves huge cost. This is because once huge investment is made on a project, withdrawing it would mean huge losses.

NCERT Solutions for class 12 Business studies Financial Management

4. Explain the factors affecting the dividend decision.

Ans: Dividend decision of a company deals with what portion of the profits is to be distributed as dividends between the shareholders and what portion is to be kept as retained earnings. The following are the factors that affect the dividend decision.

(i) Amount of Earning: A firm pays dividend out of its current and the past earnings. This implies that earnings play a key role in the dividend decision. A company having higher earnings will be in a position to pay a higher amount of dividend to its shareholders. In contrast to this, a company having low or limited earnings would distribute low dividends.

(ii) Stable Earnings: When a company has a stable and a smooth earning, they are in a position to distribute higher dividend as compared to the companies who have an unstable earning. In other words, a company having consistent and stable earnings can distribute higher amount of dividends.

(iii) Stable Dividends: Companies generally follow the practice of stabilising their dividends. They try to avoid frequent fluctuations in dividend per share and opt for increasing (or decreasing) the value only when there is a consistent rise (or fall) in the earnings of the company.

(iv) Growth Prospects: Companies aiming for a higher growth level or expansion of operations retain a higher portion of the earnings with itself for re-investment. Thus, dividend of such a company is smaller as compared to the companies with lower growth opportunities.

(v) Cash Flow Position: Dividend payments require cash outflow. If a company is low on cash then the dividend will be lower as compared to the company which has more liquidity. Even if a company has higher profits, it will not be able to distribute high dividends if it does not have enough cash.

(vi) Preference of the Shareholders:

A company must keep in mind the preferences of the shareholders while distributing the dividends. For instance, if the shareholders prefer at least a certain amount of dividend, then the company is likely to declare the same.

(vii) Taxation Policy: Taxation policy plays an important role in deciding the dividends. If the taxation policy is such that a high rate of tax is levied on dividend distribution, then the companies are likely to distribute lower dividends. On the other, it might prefer to distribute higher dividends if the tax rate is low.

(viii) Stock Market Reactions: The amount of dividend that a company distributes affects its stock market prices. An increase in dividend by a company is viewed as a good sign by the investors and the stock price of the company goes up. On the other hand, a fall in the dividends adversely affects the stock prices. Thus, while taking the dividend decision, a company must consider the probable stock market reactions.

(ix) Contractual Constraints: Sometimes, while giving out loans to a company, the lender may impose some restrictions in the form of agreement. These restrictions may be related to the dividend paid in the future. In such cases, the company has to keep such agreements in mind when distributing the dividends.

(x) Access to Capital Market:

The companies that have a greater access to the capital market tend to pay higher dividends. This is because they can rely less on retained earnings and more on other sources due to the market access. The smaller companies who have lower access to capital markets tend to pay lower dividends.

(xi) Legal Constraints: Companies have to adhere to the rules and policies laid out by the Companies Act. Thus, any company needs to take care of such restrictions and policies before declaring the dividends.

NCERT Solutions for class 12 Business studies Financial Management

5. Explain the term ”Trading on Equity”. Why, when and how it can be used by a company?

Ans: Trading on equity refers to a practice of raising the proportion of debt in the capital structure such that the earnings per share increases. A company resorts to Trading on Equity when the rate of return on investment is greater than the rate of interest on the borrowed fund. That is, the company resorts to Trading on Equity in situation of favourable financial leverage. As the difference between the return on investment and the rate of interest on debt increases, the earnings per share increase.

The use of Trading on Equity is explained in detail with the help of the following example.

Suppose there are two situations for a company. In situation I it raises a fund of Rs 5,00,000 through equity capital and in situation II, it raises the same amount through two sources- Rs 2,00,000 through equity capital and the remaining Rs3,00,000 through borrowings.

Also suppose the tax rate is 30% and the interest on borrowings is 10%. The earnings per share (EPS) in the two situations is calculated as follows.

| Situation I | Situation II | |

| Earnings before interest and tax (EBIT) | 1,00,000 | 1,00,000 |

| Interest | 30,000 | |

| Earnings Before Tax (EBT) | 1,00,000 | 70,000 |

| Tax | 30,000 | 21,000 |

| Earnings After Tax (EAT) | 70,000 | 79,000 |

| No. Of equity shares | 50,000 | 20,000 |

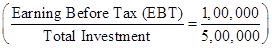

EPS= |  =1.4 =1.4 |  =3.95 =3.95 |

Clearly, in the second situation the EPS is greater than in the first situation. In the second situation the company takes advantage of the Trading on Equity and raises the EPS. Here, the return on investment calculated as  is 20% while the interest on the borrowings is 10%. Thus, the Trading on Equity is profitable.

is 20% while the interest on the borrowings is 10%. Thus, the Trading on Equity is profitable.

However, it should be noted that Trading on Equity is profitable and should be used only when the return on investment is greater than the interest on borrowed funds. In case the return on investment is less than the rate of interest to be paid, the Trading on Equity should be avoided.

Suppose instead of Rs 1,00,000 the company earns just Rs 25,000. In such a case the EPS are calculated as follows.

| Situation I | Situation II | |

| Earnings before interest and tax (EBIT) | 40,000 | 40,000 |

| Interest | 10,000 | |

| Earnings Before Tax (EBT) | 25,000 | 10,000 |

| Tax | 30,000 | 3,000 |

| Earnings After Tax (EAT) | 70,000 | 7,000 |

| No. Of equity shares | 50,000 | 20,000 |

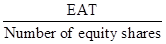

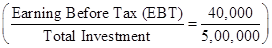

EPS= |  =1.4 =1.4 |  =3.5 =3.5 |

Clearly in this case, the EPS in Situation II falls. Here the return on investment is only 8%  while the interest on the borrowings is 10%.

while the interest on the borrowings is 10%.

Thus, in this situation the Trading on Equity is not favourable and should be discouraged. Hence, it can be said that a firm can use Trading on Equity if it is earning high profits and can increase the EPS by raising more funds through borrowings.

NCERT Solutions for Class 12 Business studies

NCERT Solutions Class 12 Business studies PDF (Download) Free from myCBSEguide app and myCBSEguide website. Ncert solution class 12 Business studies includes text book solutions from both part 1 and part 2. NCERT Solutions for CBSE Class 12 Business studies have total 20 chapters. 12 Business studies NCERT Solutions in PDF for free Download on our website. Ncert physics class 12 solutions PDF and Business studies ncert class 12 PDF solutions with latest modifications and as per the latest CBSE syllabus are only available in myCBSEguide

CBSE app for student

To download NCERT Solutions for class 12 Physics, Chemistry, Biology, History, Political Science, Economics, Geography, Computer Science, Home Science, Accountancy, Business Studies and Home Science; do check myCBSEguide app or website. myCBSEguide provides sample papers with solution, test papers for chapter-wise practice, NCERT solutions, NCERT Exemplar solutions, quick revision notes for ready reference, CBSE guess papers and CBSE important question papers. Sample Paper all are made available through the best app for CBSE students and myCBSEguide website.

Test Generator

Create question paper PDF and online tests with your own name & logo in minutes.

Create Now

myCBSEguide

Question Bank, Mock Tests, Exam Papers, NCERT Solutions, Sample Papers, Notes

Install Now